With a c. $2.5t market value and c. 300m users at Oct 2021, the digital asset universe is too large to ignore, and crypto-based digital assets could form an entirely new asset class. This scale was reached as a result of a crypto boom over the past year and there has been a long list of companies that have rode on this wave, across the blockchain ecosystem. This spans from the ‘L1/2 infrastructure/DLT’ (Arbitrum, Polygon/Matic, Solana) to application layer products like crypto on-ramp (Coin Hako, Pintu, Ramp) and CEX/DEX (FTX, Binance, dydx, DeversiFi) as well as ancillary services like regtech (Chainalysis, Quantstamp) and data analytics (Dune, Lukka).

While the past year has been an exciting period for the sector, it has also undergone significant corrections, most recently in 2018 and 2021. As compared to the previous crash, there have been a few key developments.

Increased regulation and interest by traditional finance

While regulatory uncertainty is a large near-term risk, it can drive increased participation over the long-term once the “rules of the road” are established. Some of the developments in this respect are as follows:

- China

- In Sep 2021, China banned cryptocurrencies, taking a stronger stance than before with the involvement of multiple government agencies, which led to increased market volatility and the decline of BTC price by 5%, to c. $42.5k, and it has since rebounded to c. $60.6k as of 27 Oct 2021.

- Concurrently, China is on track to be one of the first major countries to roll out the digital yuan CBDC, by Feb 2022, which can spur greater retail adoption.

- U.S.

- There is still no harmonized framework there for cryptocurrency regulation, between the SEC, CFTC and FinCen.

- Cryptocurrency exchanges like Coinbase (COIN) are legal and fall under the regulatory scope of the Bank Secrecy Act (BSA), a law overseeing the activity of financial institutions and payments transmitters.

- The regulatory landscape is still evolving, with various government bodies proposing ways to regulate cryptocurrencies.

- Europe

- Cryptocurrency is legal throughout most of the European Union (EU), although exchange governance depends on individual member states.

- Taxation varies by country, ranging from 0 to 50%.

- In Sep 2020, the EU Commission published a proposal for the regulation of digital assets Markets in Crypto-Assets Regulation (MiCA).

- in Sep 2020, the Swiss Parliament passed the distributed ledger technology (DLT) blanket act , which adapts 10 existing federal laws, with the aim of improving the conditions for blockchain and DLT companies in Switzerland, to enter into force in two stages.

- Singapore

- In 2021 , an amendment to the Payments Services Act was passed in Parliament, expanding regulations to cover digital asset service providers that do not possess the money or digital payment tokens of customers.

- o The tax authority of Singapore (Inland Revenue Authority of Singapore, IRAS) , treats digital tokens received for payment for goods and services as taxable income, while businesses that buy and sell / trade digital tokens will be taxed on the profit derived from trading in the digital token.

- Supranational organizations

- For example the Financial Action Task Force (FATF) , have just begun to set standards and expectations to address financial crime in crypto.

- They had in Jun 2015 issued a guidance to make recommendations on to the oversight of Virtual Currency Payment Products and Services (VCPPS), specifically Anti-Money Laundering (AML)/Combating the Financing of Terrorism (CFT) requirements.

- Traditional financial institutions (e.g. DBS in SG) offering cryptocurrency services also serve as a signal to the legitimacy of it.

Increase in the number of use cases

This is largely due to the rapid innovation in blockchain technology.

- The two most notable to date are Decentralized Finance (DeFi), and Non-fungible Tokens (NFTs)

- DeFi

- Accessed through decentralized applications (dApps) and allows users to utilize financial products and services, such as lending, borrowing, insurance and trading, without relying on a traditional financial institution.

- Unlike traditional financial services, which rely on intermediaries such as banks, exchanges, or brokerages to manage and process transactions, DeFi services eliminate intermediaries, are peer-to-peer (or peer-to-smart contract), and are typically encoded within smart contracts and protocols.

- v. It aims to democratize financial access in ways that will reduce the fees and costs of financial products, increase the speed and settlement times of payments and transactions, improve the stability of financial systems, and increase transparency via open blockchains.

- NFTs

- Blockchain-stored certificate of authenticity for unique digital or physical objects, which is a new way for creators to connect with fans and receive compensation.

- They are also a cost-effective way for brands to reach customers.

- Investors can currently transact with NFTs via dedicated online platforms or auction houses. OpenSea, Rarible, SuperRare, Artion and Spores (in SEA) are online marketplaces for NFT items.

Scaling solutions

The ethereum and bitcoin blockchains focus on decentralization and security, sacrificing speed. There have been many developments in L1/L2 scaling solutions that enhance performance and usability of blockchain protocols.

- This refers to a blockchain’s ability to support high transactional throughput and future growth.

- This means that as use cases expand and adoption of blockchain tech accelerates, the performance of a scalable blockchain will not.

- There are 3 aspects of this

- Existing Layer-1 (L1) blockchains upgrading, for example Eth2 for the Ethereum blockchain

- Layer-2 (L2) solutions through Optmistic rollups (e.g. Arbitrum, Optimism) or zero-knowledge rollups (ZK-rollups) being developed (e.g. Starkware, Loopring – think of these as zipping up files into a folder and processing just that compressed fold)

- New L1 blockchains being developed (e.g. Solana, Terra, Avalanche)

Observations from user and volume data

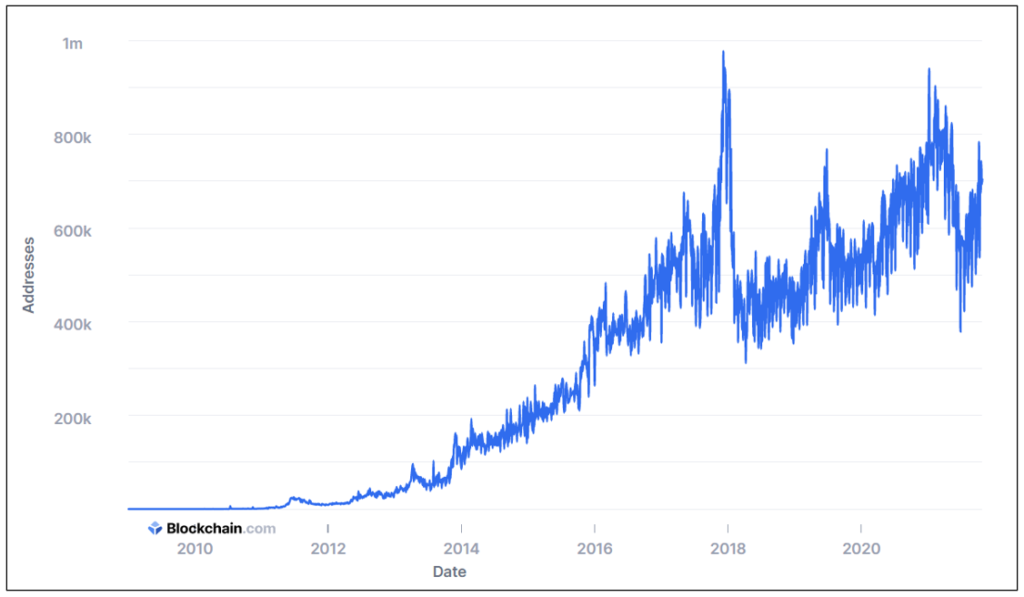

User data

- The number of bitcoin blockchain users has continued to steadily increased, although in the two most recent crashes, the number of unique addresses declined significantly

- From a peak of c. 978k in Dec 2017 to c. 311k in Apr 2018 (-68%) a level last reached in Jul 2016. The highest ever since was in Feb 2021, taking close to 34 months to achieve c. 97% of the previous peak user numbers. It took 12 months to recover to double the trough number of users, c. 622k in Apr 2019.

- From a peak of c. 940k in Feb 2021 to c. 379k in Jun 2021 (-59%), a level last reached in Aug 2019. The number of unique addresses reached c. 784k in Oct 2021, taking 4 months to recover to double the trough number of users.

- This suggests that the recovery from trough is faster in the most recent crash.

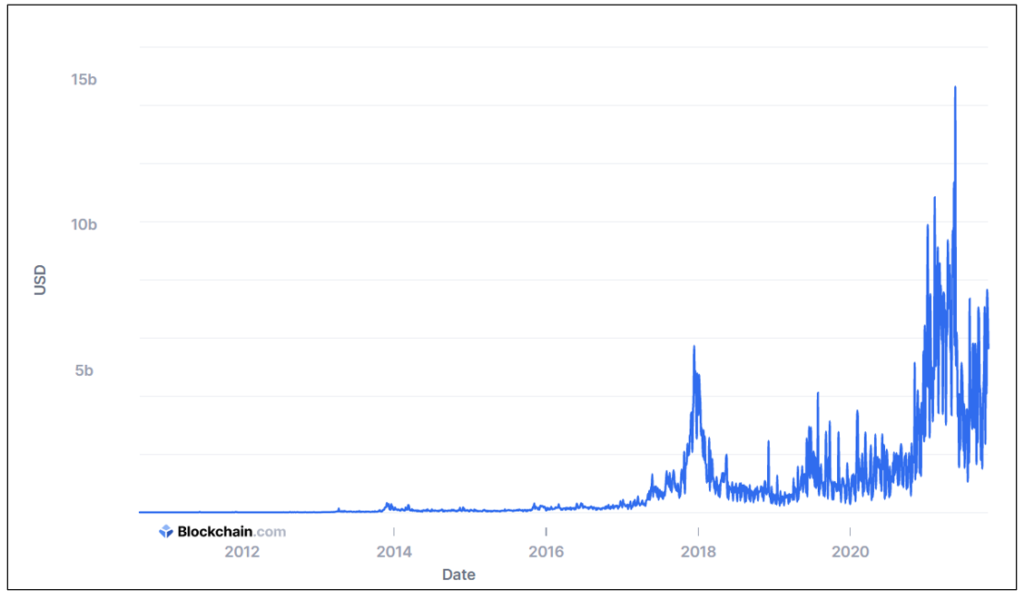

Volume

- During the 2018 crash, the average daily volume of bitcoin traded was c. $2.3b with $0.8b of standard deviation (i.e. 35.5% coefficient of variation), while during the 2021 crash, the average daily volume of bitcoin traded was $6.3b with $1.5b of standard deviation (i.e. 23.7% coefficient of variation).

- From a dollar-value basis, the magnitude of volumes and swings are very different, while on a relative basis, the swings are smaller (i.e. smaller coefficient of variation).

Conclusion

From the points above, we can see that the number of users has increased, crashes have recovered faster, with greater trading volumes and reduced volatility (coefficient of variation). This could have been driven by the key developments of regulation, use cases and efficiency of the blockchain technology, which contribute to the ‘legitimacy’ of it.

Note: A limitation is the inability to differentiate wallet address ownership or volumes by type of customer (retail or institutional). Arguably, institutional capital is stickier and can help to reduce volatility, and would transact in higher volumes.

Sources

- BAML: Digital Asset Primer in Brief Only the first inning

- Gemini: Layer-1 and Layer-2 Blockchain Scaling Solutions

- Dune

- Coinmarketcap

- The Defiant: Ethereum DeFi Projects Map