Uber, despite the toxic culture it purported to have extolled, and bad behavior that for a long time went unchecked (e.g. sexual harassment, discrimination, etc.), has left an indelible dent in the world, through incredible innovation that put it in a special group of companies whose brands have become verbs (e.g. Google). It is hence not a surprise that many entrepreneurs aspire to found a company that could be the “Uber of something” – that is, a disruptor in its industry and an instigator in the upheaval of culture in the technology scene (of course, hopefully without the cash-burning element). A simple way to view it would be the creation of a marketplace in an on-demand industry.

Industries that have been “Uberfied” and examples of such companies are: accommodation (Airbnb/HotelTonight), groceries/food (Instacart, Uber Eats), courier/freight (Lalamove, Convoy), housework (TaskRabbit, Wag), beauty/wellness (Glamsquad, Priv/beGlammed), and healthcare (Doctor On Demand, Halodoc). Retail consumer-facing industries are likely to fall under this group, and education is no exception. The education industry is expected to have a market size of ~$350B by 2025, and in particular, the education technology (edtech) industry crossed ~$18B in revenue in 2017 and is expected to grow to ~$41B by 2022, a huge opportunity that has led some to call it the “next fintech”.

Broadly, the industry consists of establishments whose primary objective is to provide instruction, training, and/or related services. They can be private, public, or not-for-profit. Some examples are schools, universities, training centers, and after-school student centers.

To add, there has been a surge of technology-enabled services and products, and edtech has evolved from just being online content access to include language apps (e.g. Duolingo, Memrise), virtual tutoring (e.g. BYJU’s, Vedantu), video conferencing tools or classrooms (e.g. Blackboard, Edmodo, Top Hat), online learning platforms (e.g. Coursera, Skillshare, Codecademy) and textbook/materials/resources platforms (e.g. Chegg, Cengage, Quizlet). Some are relatively niche and specialised, while others span across multiple categories.

Economists would argue that education is a key factor in the growth of a country and its move towards development, and is also of great efficacy in the push towards equality, being pivotal in bridging income, race, gender discrimination gaps, for example. There is little doubt of its importance, and hence a strong emphasis on it across the world. It has been the driver behind monikers such as “Tiger parenting“, a strict form of parenting whereby children are pushed to their limits to excel not only in their academics but also in extracurricular activities, such as music, art, and sport.

This is especially so in the Asian context, whereby Asian parents are frequently portrayed as demanding and controlling, as well as having extreme and, at times, polarizing views on the definitions of success and achievement. For example, law, medicine, and finance are some of the few respectable industries to work in. The following are some of the implications and observations on the industry:

- There is a strong emphasis on holistic learning – learning takes place not just in school, and what you learn outside of it (e.g. sports, the arts) is just as, if not at times even more, important

- There is a time crunch – how one organises their schedule so that it is optimised for all the learning / classes / education commitments that need to be done

- Quality matters and is highly scrutinised – students are not the only ones assessed during exams; the education practitioners are, too, as their quality and effectiveness can easily be pegged to the progress of their students

- There is a high level of competition and comparison is commonplace – ancillary services to formal education (pre-school, primary, secondary) are commoditized with a large number of practitioners (tuition teachers) and prices of online services are easily accessible

This represents a huge opportunity for companies in the region, which Snapask hopes to capture.

Who are they?

Founded in 2015 by Timothy Yu (CEO), Snapask is a Hong Kong-based mobile learning platform, which primary offering is an on-demand, short-form tutoring service to primary school and high school students, connecting them to qualified university students for one-on-one teaching. They are serving >3M students (2M in Jul 2019, 1M in Dec 2018 and 500K in Jan 2018) and have >350K tutors across 8 Asian countries (Hong Kong, Taiwan, Singapore, Malaysia, Indonesia, Thailand, Japan, and South Korea).

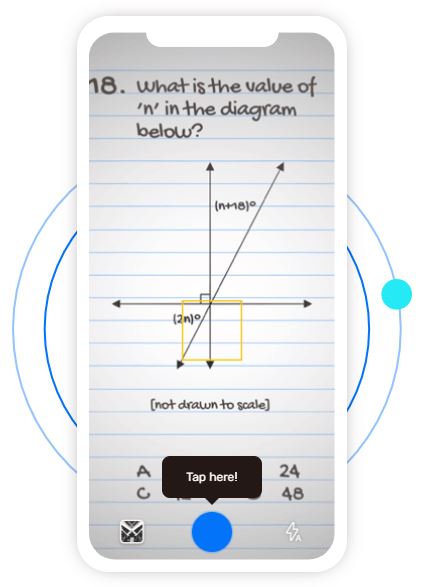

Their primary service is simple and intuitive. A student would take a picture of a question that they have and upload it on the app or website, which gets added to a pool of questions from which prospective tutors would choose to answer. When the student is satisfied with the answer, it is marked as solved and added to a tally of the tutor. Once a tutor accumulates a certain number of solved questions, they then are able to cash out.

In addition, they have value-added services such as video lessons, practices and mini-classes, that help to curate a more holistic education experience for students. For example, in April 2020, Snapask went into a partnership with the Singapore Press Holdings to offer students free subscriptions as well as access to a curated news content from state newspapers The Straits Times, and will also work with their team of teaching experts and editors to curate articles and co-create news content. It is reported that they similarly did the same in Japan, Taiwan, South Korea, and Indonesia.

Snapask also has a B2B enterprise product, Wizmo, that supports teachers and schools, through AI technology in mining learning data to generate insights, to provide personalized service and hence enhance everyday teaching and learning in the classroom. Through Sofasoda, it provides digital content and interactive courses in soft skills to prepare recent university graduates for long-term career success in the workplace. Finally, Snapask’s “Academy” webpage provides helpful tips on learning skills for students and parenting tips.

Financials

Revenue model

Snapask has three revenue streams, gleaned from research of some of its earliest markets. First, in the token model, students will purchase per-question credits. The number of questions in each pack varies across countries, and the same can be said for pretty much all three revenue streams. It is not clear if there is an expiry date for the token packs.

Snapasks’ second revenue stream comes from subscriptions. Hong Kong is the only market where there is a 4 month-long subscription, whereas all other were monthly subscriptions, and differ on the maximum number of questions a student could ask. Except when compared to the token packs with a relatively lower number of questions (e.g. 5 or 10), buying a subscription plan with a greater number of questions does not substantially reduce the per question price (e.g. in HK, a 20 question token pack would go for HKD 16.5/qn while a 50 question subscription for HKD 12.8/qn, representing a ~25% discount). From a broader perspective, the per question cost on Snapask is a lot cheaper than if one were to attend a one-on-one consultation / tuition session, which ranges from HKD 150-200 per hour for 60 – 75 minutes.

| Local Currency | HK (HKD) | SG (SGD) 5.57 HKD | TW (NT) 0.26 HKD | ID (‘000 IDR) 0.52 HKD |

|---|---|---|---|---|

| Token (1) | ||||

| 5 questions | NA | $19.98 | NA | NA |

| 10 questions | 180 | NA | 590 | 99 |

| 20 questions | 330 | NA | NA | NA |

| 30 questions | NA | $68.98 | NA | 239 |

| Subscription (2) | ||||

| 25 questions | NA | NA | 1,190 | NA |

| 50 questions | 640 | $108.98 | 1,990 | NA |

| 60 questions | NA | NA | NA | 459 |

| 1 mo unlimited | 880 | $168.98 | 3,290 | NA |

| 4 mo unlimited | 2,580 | NA | NA | NA |

| Mini Classes (3) | ||||

| 1 class | NA | $10.98 | NA | 29 |

| 2 classes | NA | NA | 990 | NA |

| 4 classes | NA | NA | 1,890 | NA |

| 6 classes | NA | NA | NA | 89 |

| 8 classes | NA | $78.98 | NA | NA |

| 12 classes | NA | NA | NA | 179 |

Source: Snapask website

Tutor information and costs

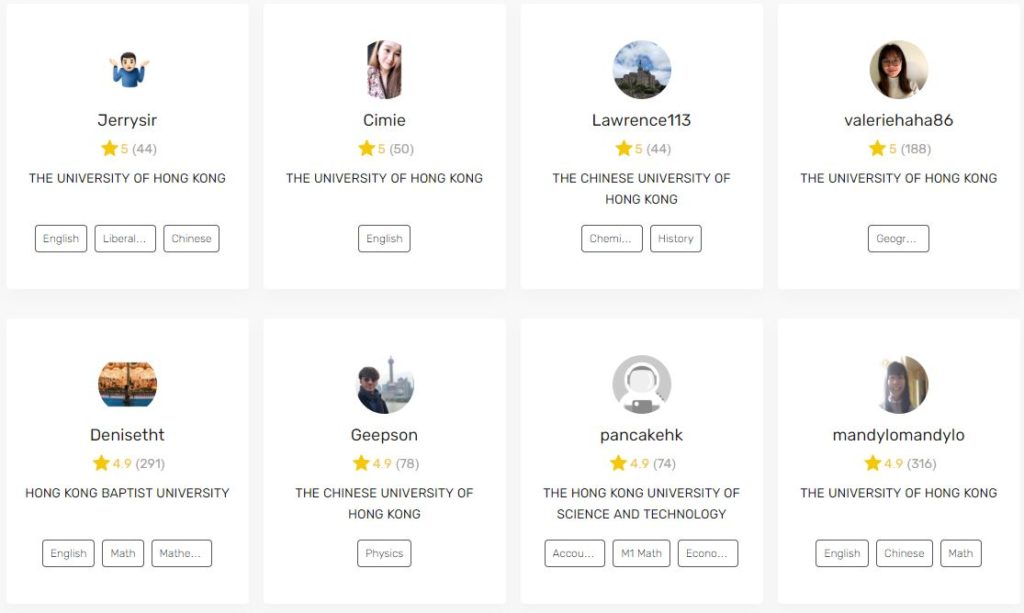

There are three different levels of tutors. One automatically joins as a “Trainee Tutor” upon signing up, and there is a 2 week long probation period where teaching quality is evaluated based on the following standards, which is consistent across all markets

- Answer at least 10 sessions in 2 weeks

- No invalid sessions (defined as those that are deemed to not have helped students, where unpleasant attitudes and vulgarities are used, no or wrong answer given, and slow response, i.e. >15mins)

- Need to receive a rating of 4 and above from students

There will also be no remuneration for any sessions conducted and work done while one is a trainee tutor. Once these requirements are fulfilled, one becomes a Snapask Certified Tutor, which essentially allows the receipt of payments. The final level is the Snapask Elite Tutor, which might get one featured on Snapask’s homepage.

At present, it seems challenging to fulfill the requirements to pass probation, based on an experiment done on the SG app. During a peak-period weekday afternoon, questions came in at ~5-minute intervals, which slowed down to ~15-20 minutes at night. The questions were mostly math and each question had on average 10 tutors competing to be selected by Snapask’s algorithm to answer the question. Unless SG is an anomaly, this stands in contrast with Yu’s claim in Feb 2020 that “the average time for students to connect with a tutor after asking a question is about 15 to 20 minutes”. It is hard to fathom how it would be worthwhile to join as a tutor unless one had already established themselves as a tutor that is optimized to be selected by their algorithm (e.g. based on the number of questions answered, rating by students). From Snapask’s perspective, it seems like a good problem to have – tutor supply exceeds question demand and so they can afford to focus less on tutor retention.

Profitability

While not directly comparable due to its wider range of services, public-listed Chegg, in its most recent reported quarter ended Mar 2020, had gross profits of 68%. The most comparable segment would be “Chegg Tutors”, which allows students to get online tutor help. However, the segment financials are not broken out separately. It was mentioned in the management discussion that in 2020 they expect the cost of revenues to increase (and gross margin decrease) because of costs related to owning print textbooks. Assuming that Snapask spends a similar, or likely even more, on marketing and R&D, it is hard to imagine them being profitable. This is exacerbated by the free-trial promotions that they are running during the COVID-19 period to acquire customers.

At the time of their Series B in Feb 2020, Yu mentioned “In 2018 and 2019 we were cash-flow positive, and this year, we do expect to be profitable”.

| Local Currency | HK | SG |

|---|---|---|

| Payment per question (LCY) | 5 | 1 |

| Min. no. questions | 25 | 25 |

| Bonuses | ||

| Days (working) for payment | <10 | <10 |

| Per question economics (1) | ||

| Revenue | 12.8 | 2.2 |

| Cost | 5.0 | 1.0 |

| Gross profit (% margin) | 7.8 60.9% | 1.2 54.6% |

Competitive landscape

There is no easy or direct comparison with other edtech companies. Chegg Tutor, for example, is a business segment of Chegg (U.S.), which offers a much broader range of services (the core of which being education materials such as textbooks) or Vedantu (India) which is focused on CBSE Class 12 (the equivalent of GCSE “A-levels” or U.S. high school). The pricing structure also varies, as summarised below.

Although not directly comparable, Bangalore-based edtech darling BYJU’s started offering free live classes on its Think and Learn app in response to rising demand due to COVID-19. Chinese internet giant Tencent formed Tencent Education in 2019, which brings together a variety of edtech tools, such as Study.qq.com (English translation/learning) and learning (vocational education). Other similar companies that are not listed above are Skooli (pay-as-you-go), Wyzant (tutor matching for in-person/online), eTutorWorld (K-12 tutoring, and test prep) and TutorMe (tutors from Ivy League colleges, 4% tutor acceptance rate). These products and services are highly localised, to complement the education system of each country, technology adoption, and propensity/capability to spend on education, all of which can vary widely by country.

| $US unless otherwise stated | Snapask | Chegg Tutor | Vedantu |

|---|---|---|---|

| Students | 3M | >3.9M (all services) | >75K paying >25M free |

| No. of tutors | 350K | 3K (2013) | >500 |

| Tutor pay | ~$1/qn | $20+/hr | Tutor-set |

| Qns / month | >2M | – | – |

| Avg. tutoring session | 15-20mins | – | – |

| Pricing | Question packs or monthly subscription | $6.95 / lesson $14.95 mo unlimited lessons $30 mo, 60 min video | Rs 100 / qn Rs 50K courses |

| Subjects | “All”: Math, science, physics, biology, korean, english etc. | Accounting, math, sciences, economics, finance, statistics | CBSE Class 12. E.g. Math, sciences, hindi, accounting, economics, political science, physical education |

| Others | – | All tutors are required to have tutoring / teaching experience and must be enrolled in or have a degree from a four-year university | Flexibility to set teaching price |

Sources as linked directly

What is the team and who are the investors?

Snapask was founded in 2015 by Timothy Yu (CEO) and Bradley Chiang, who left the company in July 2016 and is now an associate at consulting firm McKinsey & Company. A significant majority of their key personnel are based in either Hong Kong or Taiwan.

- Timothy Yu (CEO) – Founder, graduate of HKU

- Bradley Chiang (NA) – No longer with the company

- Katherine Cheung (CMO) – Joined Snapask as a marketing associate in Sep 2016

- Jason Wang (Lead Designer)

- Stephanie Su (Chief of Staff) – Joined Snapask in Sep 2019, previously spent 2 years as a GM at sales agency Saleswork Group Asia, and as a director of channel/OEM relations APAC/China at Absolute Software, a computer/mobile security firm, as well as 5.5 years marketing experience at ASUS

- Raymond Huang (Lead Engineer) – Joined Snapask in Jun 2017, previously GM at now-defunct social media platform migme, 5 years at computer networking company Gemtek Technologies, and 7 years software engineering experience

- Ingrid Chung (Business Development) – Joined Snapask in Sep 2015 and held roles across community management, public relations and education solutions. Graduate from HKU.

Their most recent round was a $35M Series B in February 2020, led by Asia Partners and Intervest. Its other investors have included Kejora Ventures (a return investor), Ondine Capital and SOSV Chinaccelerator. To date, they have raised $50M. These new funds were going to be used to expand their regional footprint, specifically into Vietnam, set up their regional headquarters in Singapore and double their headcount by hiring 100 people. They are also aiming to develop video content and analytics products for its platform.

Other investors include Cai Wensheng (Chairman of Meitu) and Welight Capital.

What is their value proposition?

They claim that their value proposition is threefold:

- Instant: Be automatically paired up with a tutor in seconds

- Credible: Over 350K college tutors who have top public exam results

- On-demand: Tutors are ready 24/7 for your questions

Having a strong base of quality tutors is important. Tutors from Snapask have diverse undergraduate backgrounds and have to undergo a relatively stringent selection process. Tutors are former tutorial / day school teachers, university students, and graduates.

Snapask engages their tutors through a monthly Tutor’s Townhall, conducted via Google Hangouts for product updates, best practices for tutors, and previews of upcoming changes for this quarter. In addition, they also maintain a telegram channel where tutors can learn about the latest announcements, event invitations, and other updates from the Snapask team. These initiatives help to strengthen the community, a move seen also by other successful technology startups such as neobank Revolut (Revolut Community) and personal finance platform Seedly (Seedly Community) and is important in retaining tutors.

In the current health climate, Snapask has allowed students to continue learning and getting access to help and tutors. They have extended free trials and went into partnerships to co-create content (e.g. Singapore Press Holdings), which is nice to have for customers. Importantly, the user experience is great: sign up is smooth and quick while uploading and asking a question is intuitive and straightforward. The tutor pairing system works very efficiently as well.

If numbers are a good proxy to how well they have executed on their value proposition, in an interview with South China Morning Post, Timothy Yu shared that in the first 6 months of 2020, they acquired 3.5M students across their 8 markets, after expanding beyond Southeast Asia into Japan and Korea. There has been a 50% increase in user numbers and a 40% increase in usage (defined by questions asked and time spent on face-to-face consultation).

What next for the company?

The companies in the space, as mentioned in the competitive landscape analysis, have nuances and differences around their value proposition for which Snapask can explore, and Snapask has already taken steps in this direction as they continue to innovate on its product offerings. For example, they launched a learning planner (Jan 2018), Mini Classes & Endorsement Session (Aug 2019), and Content centered product lineup (Jan 2020). Riding on the momentum of online education adoption, Snapask can continue to experiment with adjacent value-added content such learning-related articles or build a community of students and parents by way of an online forum or discussion group for sharing of experiences and tips, who could also be identified early adopters to test ideas with.

Due to the COVID-19 pandemic, the rise of the gig economy has been accelerated and digital adoption has exploded. More people are entertaining the thought of becoming independent, “own-account” workers and/or diversifying their income, while school closures are forcing students to access education materials online. Parents are also desperate for ways to entertain their children meaningfully as they spend extended time at home. This might be a reason why there is an ample supply of tutors on Snapask when the experiment was conducted and sets a great environment for which Snapask can experiment their services with, for example expanding their subject coverage, segment coverage (e.g. test prep) or structured online classes (language, skills), etc.

In conclusion…

Snapask provides an affordable and easily accessible channel for students to get access to help in their learning journey. It is likely great for one-off questions or questions that are very challenging, and will be complementary to in-person, one-to-one tuition sessions. In the extremely education-focused markets that it operates in, its products and services are unique, and potentially address key pain points of students and their parents. For education providers, it can be a valuable alternative to, or even a main source of, their income.

Their value proposition can become much stronger due the COVID-19 pandemic, which has increased the adoption of technology, and the team looks well poised to keep up with the momentum of the business. It will be exciting to see how the future pans out for them.

Sources

- On-demand tutoring app Snapask gets $35 million to expand in Southeast Asia

- Snapask Raises $35 Million in Growth Capital

- The COVID-19 pandemic has changed education forever. This is how

- Hong Kong online tutoring platform Snapask raises US$5M, targets 4 million users in Southeast Asia

- Snapask and SPH offer online tutoring and news content in support of students’ home-based learning

- Top tutor apps for the kiasu Singaporean student

- The 12 best online tutoring services for 2020

- Startup Snapask eyes breakeven in 2020 with US$35m fresh funds

- Edtech in Singapore – opportunities and growth

- Edtech is surging, and parents have some notes

- The COVID-19 recovery will be digital: A plan for the first 90 days